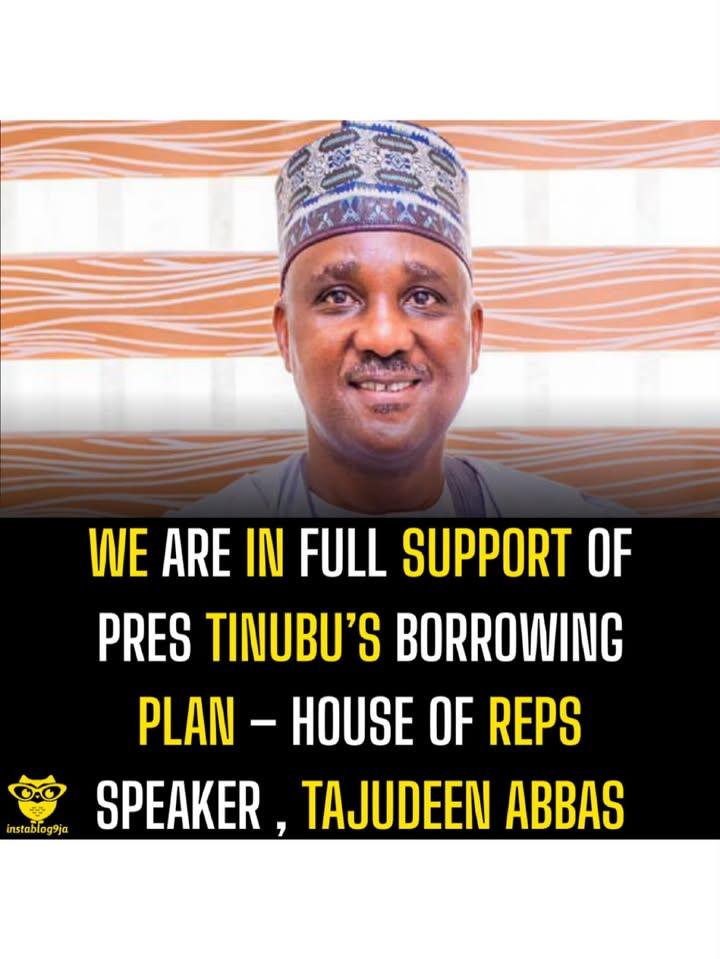

10 Nigerian States Plan N4.28tn Borrowing to Fund 2026 Budgets Amid Fiscal Concerns

Ten Nigerian states—including Lagos, Ogun, Abia, Enugu, Osun, Delta, Sokoto, Edo, Bayelsa, and Gombe—plan to raise a combined N4.287 trillion through loans, bonds, grants, and public-private partnerships to fund their 2026 budgets. The states’ total budgets amount to N14.174 trillion, highlighting growing reliance on non-recurring funds beyond federal allocations and internally generated revenue. Lagos, Ogun, and Abia are leading in borrowing for capital projects. Analysts warn that excessive reliance on debt could strain fiscal sustainability and increase debt servicing costs. Experts also emphasize the need for improved revenue management and fiscal discipline to reduce dependence on borrowing.

#NigeriaEconomy #StateBudgets2026 #FiscalSustainability #Borrowing #InfrastructureFunding

Ten Nigerian states—including Lagos, Ogun, Abia, Enugu, Osun, Delta, Sokoto, Edo, Bayelsa, and Gombe—plan to raise a combined N4.287 trillion through loans, bonds, grants, and public-private partnerships to fund their 2026 budgets. The states’ total budgets amount to N14.174 trillion, highlighting growing reliance on non-recurring funds beyond federal allocations and internally generated revenue. Lagos, Ogun, and Abia are leading in borrowing for capital projects. Analysts warn that excessive reliance on debt could strain fiscal sustainability and increase debt servicing costs. Experts also emphasize the need for improved revenue management and fiscal discipline to reduce dependence on borrowing.

#NigeriaEconomy #StateBudgets2026 #FiscalSustainability #Borrowing #InfrastructureFunding

10 Nigerian States Plan N4.28tn Borrowing to Fund 2026 Budgets Amid Fiscal Concerns

Ten Nigerian states—including Lagos, Ogun, Abia, Enugu, Osun, Delta, Sokoto, Edo, Bayelsa, and Gombe—plan to raise a combined N4.287 trillion through loans, bonds, grants, and public-private partnerships to fund their 2026 budgets. The states’ total budgets amount to N14.174 trillion, highlighting growing reliance on non-recurring funds beyond federal allocations and internally generated revenue. Lagos, Ogun, and Abia are leading in borrowing for capital projects. Analysts warn that excessive reliance on debt could strain fiscal sustainability and increase debt servicing costs. Experts also emphasize the need for improved revenue management and fiscal discipline to reduce dependence on borrowing.

#NigeriaEconomy #StateBudgets2026 #FiscalSustainability #Borrowing #InfrastructureFunding

0 Comments

·0 Shares

·116 Views