NAF Bombs Several ISWAP Terrorists, Bandits To Death In Multiple Airstrikes.

Air strikes carried out by the Nigerian Air Force (NAF) have resulted in the killing of several terrorists and bandits across the country and the destruction of their hideouts.

According to a statement on Monday by the NAF Spokesman, Air Commodore Ehimen Ejodame, scores of Islamic State of West Africa Province (ISWAP) terrorists in Mallam Fatori and Shuwaram, Borno State, as well as bandits’ enclaves in Garin Dandi and Chigogo, Kwara State, as well as Zango Hill in Kankara local government area of Katsina State, were affected by the strikes.

He added that the coordinated missions were carried out on November 9, 2025, based on credible intelligence on the movement and activities of the criminals.

Ejodame said the missions represent a decisive phase in ongoing joint operations under Operation Hadin Kai and Operation Fansan Yamma, aimed at degrading terrorists and criminal networks across Nigeria’s northern theatres.

News reports that the NAF airstrikes dealt a heavy blow to ISWAP terrorists entrenched in the Northern Tumbuns of Borno State.

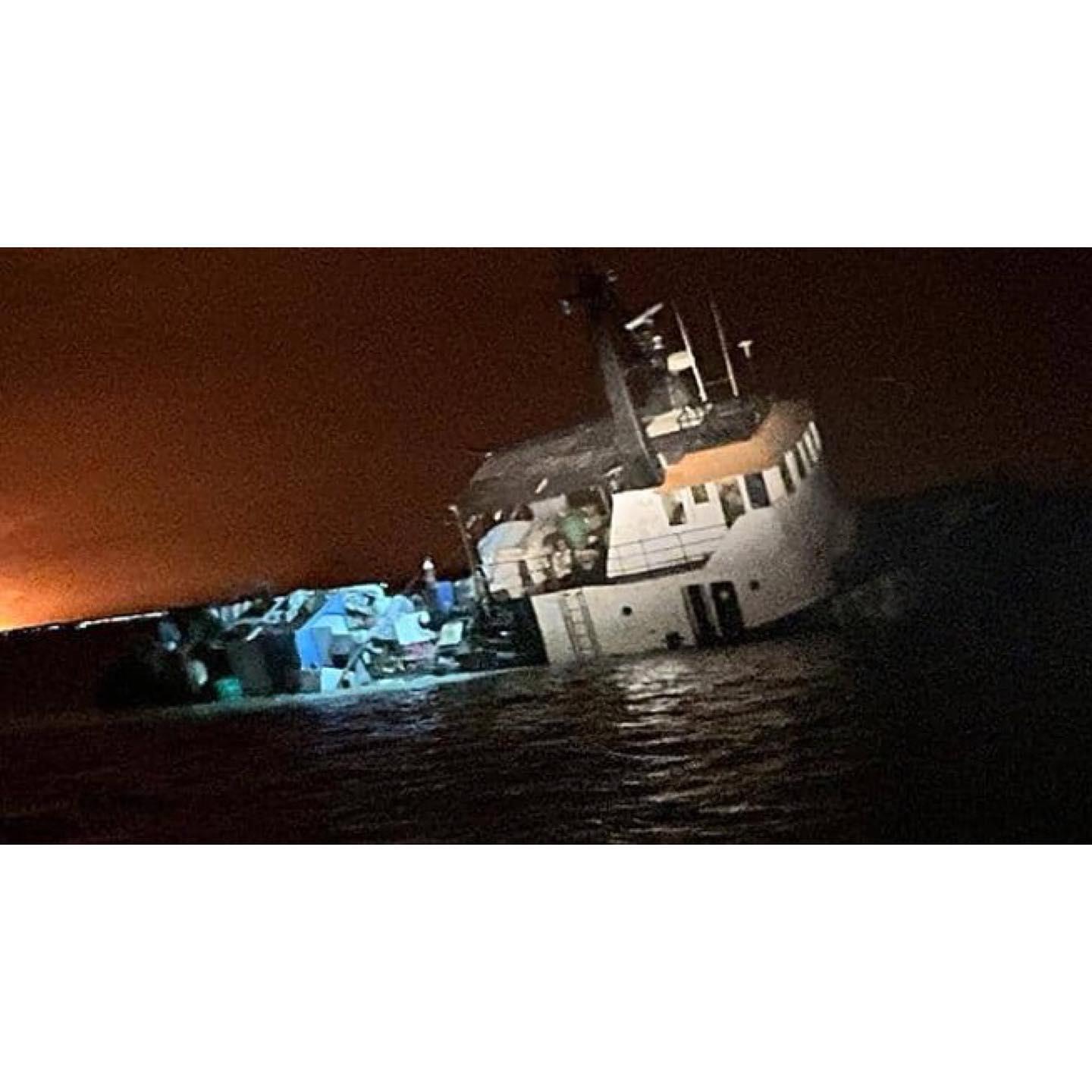

According to the NAF spokesman, the Air Component guided by real-time Intelligence, Surveillance, and Reconnaissance (ISR) feeds conducted precision strikes southeast of Shuwaram before shifting to Mallam Fatori, where ISWAP elements were observed mobilising with motorcycles and boats along the Lake Chad Basin.

According to him, the strikes destroyed the insurgent hideouts, logistics hubs, and weapons storage facilities, eliminating several terrorists and crippling their mobility capabilities.

“Post-strike assessments confirmed multiple neutralizations and a significant degradation of ISWAP’s operational networks in the area,” he said.

Similarly, NAF aircraft carried out precision air interdiction missions over Garin Dandi and Chigogo in Kwara State, striking bandits,’ camps with devastating accuracy based on credible intelligence.

He said the attacks caused panic in the enemy camp and inflicted heavy losses among the criminals.

In a related operation, air assets under Operation Fansan Yamma struck Zango Hill in Kankara LGA, Katsina State, the hideout of a terrorist kingpin and his fighters.

Ejodame said the aircraft guided by actionable intelligence and ISR surveillance, executed multiple attack passes, destroying key logistics hubs and neutralizing several terrorists in one of the most decisive strikes in the region.

Furthermore, the Air Component of Operation Fansan Yamma (Sector 1) conducted an Armed Reconnaissance mission across the northwest corridor, covering key settlements in Zamfara, Kebbi, and Kaduna States, including Kakihum, Dankolo, Kotonkoro, and Kuyello.

Ejodame said the locations served as known routes and hideouts for armed groups along the Birnin Gwari–Funtua axis.

“During the mission, coordination with Forward Operating Bases at Dankolo and Kotonkoro revealed suspicious movement near Wam Hill, where terrorists on motorcycles were spotted attempting to flee. The aircrew swiftly engaged and neutralized the targets, with no further hostile activity observed,” he said.

NAF Bombs Several ISWAP Terrorists, Bandits To Death In Multiple Airstrikes.

Air strikes carried out by the Nigerian Air Force (NAF) have resulted in the killing of several terrorists and bandits across the country and the destruction of their hideouts.

According to a statement on Monday by the NAF Spokesman, Air Commodore Ehimen Ejodame, scores of Islamic State of West Africa Province (ISWAP) terrorists in Mallam Fatori and Shuwaram, Borno State, as well as bandits’ enclaves in Garin Dandi and Chigogo, Kwara State, as well as Zango Hill in Kankara local government area of Katsina State, were affected by the strikes.

He added that the coordinated missions were carried out on November 9, 2025, based on credible intelligence on the movement and activities of the criminals.

Ejodame said the missions represent a decisive phase in ongoing joint operations under Operation Hadin Kai and Operation Fansan Yamma, aimed at degrading terrorists and criminal networks across Nigeria’s northern theatres.

News reports that the NAF airstrikes dealt a heavy blow to ISWAP terrorists entrenched in the Northern Tumbuns of Borno State.

According to the NAF spokesman, the Air Component guided by real-time Intelligence, Surveillance, and Reconnaissance (ISR) feeds conducted precision strikes southeast of Shuwaram before shifting to Mallam Fatori, where ISWAP elements were observed mobilising with motorcycles and boats along the Lake Chad Basin.

According to him, the strikes destroyed the insurgent hideouts, logistics hubs, and weapons storage facilities, eliminating several terrorists and crippling their mobility capabilities.

“Post-strike assessments confirmed multiple neutralizations and a significant degradation of ISWAP’s operational networks in the area,” he said.

Similarly, NAF aircraft carried out precision air interdiction missions over Garin Dandi and Chigogo in Kwara State, striking bandits,’ camps with devastating accuracy based on credible intelligence.

He said the attacks caused panic in the enemy camp and inflicted heavy losses among the criminals.

In a related operation, air assets under Operation Fansan Yamma struck Zango Hill in Kankara LGA, Katsina State, the hideout of a terrorist kingpin and his fighters.

Ejodame said the aircraft guided by actionable intelligence and ISR surveillance, executed multiple attack passes, destroying key logistics hubs and neutralizing several terrorists in one of the most decisive strikes in the region.

Furthermore, the Air Component of Operation Fansan Yamma (Sector 1) conducted an Armed Reconnaissance mission across the northwest corridor, covering key settlements in Zamfara, Kebbi, and Kaduna States, including Kakihum, Dankolo, Kotonkoro, and Kuyello.

Ejodame said the locations served as known routes and hideouts for armed groups along the Birnin Gwari–Funtua axis.

“During the mission, coordination with Forward Operating Bases at Dankolo and Kotonkoro revealed suspicious movement near Wam Hill, where terrorists on motorcycles were spotted attempting to flee. The aircrew swiftly engaged and neutralized the targets, with no further hostile activity observed,” he said.