Why Is the Nigerian Government Restricting School Graduation Ceremonies to Only Final Classes—Is This the End of Costly, Fee-Driven Celebrations in Primary and Secondary Schools?

Is Nigeria finally putting an end to the growing culture of expensive and repetitive school graduations? The Federal Government has announced a new education policy that restricts graduation ceremonies to only final-year classes—Primary 6, Junior Secondary School 3 (JSS3), and Senior Secondary School 3 (SSS3)—effectively banning the practice of holding graduation events for lower classes across the country.

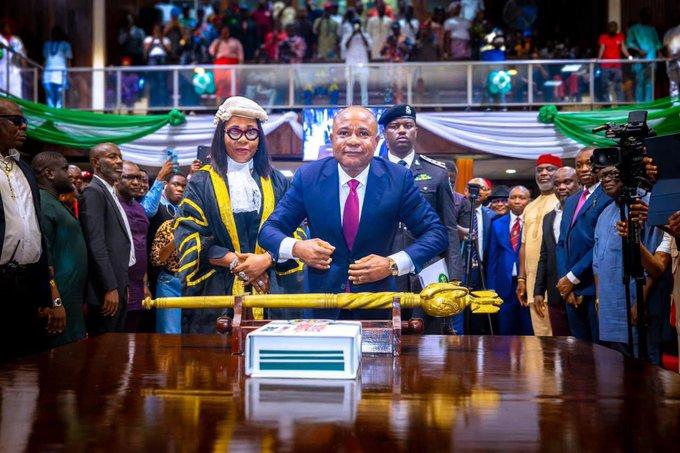

The policy was unveiled by the Minister of Education, Maruf Tunji Alausa, alongside the Minister of State for Education, Prof. Suiwaba Sai’d, as part of a broader reform agenda aimed at reducing the financial burden on parents and restoring focus to academic learning rather than ceremonial displays.

According to the ministers, graduation ceremonies in many schools have become increasingly commercialized, with families often compelled to pay for gowns, souvenirs, photography, and multiple celebrations within a single academic year. These expenses, they said, place unnecessary pressure on households already struggling with the rising cost of education.

By limiting graduations strictly to terminal classes, the government says it intends to eliminate fee-driven school practices and promote a more affordable and sustainable education system. The graduation reform also aligns with other cost-cutting measures introduced in the sector, including changes to textbook usage, academic planning, and resource sharing, which are designed to allow learning materials to be reused across multiple academic sessions.

The policy further supports the introduction of a uniform national academic calendar, aimed at improving consistency in teaching, planning, and school administration while discouraging activities that impose additional financial strain on parents.

Education officials insist that the move is not about diminishing students’ achievements but about resetting priorities in Nigerian schools—placing learning outcomes, classroom quality, and academic development above pageantry and social competition.

However, the decision raises critical questions: Will schools comply fully with the new directive? How will private institutions adapt? And will the policy truly ease household education costs or face resistance from schools that rely on graduation-related fees? As implementation begins, parents, educators, and school administrators will be watching closely to see whether this reform marks a lasting shift toward affordability and academic focus—or sparks a new debate over tradition, celebration, and school funding in Nigeria’s education system.

Is Nigeria finally putting an end to the growing culture of expensive and repetitive school graduations? The Federal Government has announced a new education policy that restricts graduation ceremonies to only final-year classes—Primary 6, Junior Secondary School 3 (JSS3), and Senior Secondary School 3 (SSS3)—effectively banning the practice of holding graduation events for lower classes across the country.

The policy was unveiled by the Minister of Education, Maruf Tunji Alausa, alongside the Minister of State for Education, Prof. Suiwaba Sai’d, as part of a broader reform agenda aimed at reducing the financial burden on parents and restoring focus to academic learning rather than ceremonial displays.

According to the ministers, graduation ceremonies in many schools have become increasingly commercialized, with families often compelled to pay for gowns, souvenirs, photography, and multiple celebrations within a single academic year. These expenses, they said, place unnecessary pressure on households already struggling with the rising cost of education.

By limiting graduations strictly to terminal classes, the government says it intends to eliminate fee-driven school practices and promote a more affordable and sustainable education system. The graduation reform also aligns with other cost-cutting measures introduced in the sector, including changes to textbook usage, academic planning, and resource sharing, which are designed to allow learning materials to be reused across multiple academic sessions.

The policy further supports the introduction of a uniform national academic calendar, aimed at improving consistency in teaching, planning, and school administration while discouraging activities that impose additional financial strain on parents.

Education officials insist that the move is not about diminishing students’ achievements but about resetting priorities in Nigerian schools—placing learning outcomes, classroom quality, and academic development above pageantry and social competition.

However, the decision raises critical questions: Will schools comply fully with the new directive? How will private institutions adapt? And will the policy truly ease household education costs or face resistance from schools that rely on graduation-related fees? As implementation begins, parents, educators, and school administrators will be watching closely to see whether this reform marks a lasting shift toward affordability and academic focus—or sparks a new debate over tradition, celebration, and school funding in Nigeria’s education system.

Why Is the Nigerian Government Restricting School Graduation Ceremonies to Only Final Classes—Is This the End of Costly, Fee-Driven Celebrations in Primary and Secondary Schools?

Is Nigeria finally putting an end to the growing culture of expensive and repetitive school graduations? The Federal Government has announced a new education policy that restricts graduation ceremonies to only final-year classes—Primary 6, Junior Secondary School 3 (JSS3), and Senior Secondary School 3 (SSS3)—effectively banning the practice of holding graduation events for lower classes across the country.

The policy was unveiled by the Minister of Education, Maruf Tunji Alausa, alongside the Minister of State for Education, Prof. Suiwaba Sai’d, as part of a broader reform agenda aimed at reducing the financial burden on parents and restoring focus to academic learning rather than ceremonial displays.

According to the ministers, graduation ceremonies in many schools have become increasingly commercialized, with families often compelled to pay for gowns, souvenirs, photography, and multiple celebrations within a single academic year. These expenses, they said, place unnecessary pressure on households already struggling with the rising cost of education.

By limiting graduations strictly to terminal classes, the government says it intends to eliminate fee-driven school practices and promote a more affordable and sustainable education system. The graduation reform also aligns with other cost-cutting measures introduced in the sector, including changes to textbook usage, academic planning, and resource sharing, which are designed to allow learning materials to be reused across multiple academic sessions.

The policy further supports the introduction of a uniform national academic calendar, aimed at improving consistency in teaching, planning, and school administration while discouraging activities that impose additional financial strain on parents.

Education officials insist that the move is not about diminishing students’ achievements but about resetting priorities in Nigerian schools—placing learning outcomes, classroom quality, and academic development above pageantry and social competition.

However, the decision raises critical questions: Will schools comply fully with the new directive? How will private institutions adapt? And will the policy truly ease household education costs or face resistance from schools that rely on graduation-related fees? As implementation begins, parents, educators, and school administrators will be watching closely to see whether this reform marks a lasting shift toward affordability and academic focus—or sparks a new debate over tradition, celebration, and school funding in Nigeria’s education system.

0 Commentaires

·0 Parts

·499 Vue