EFCC Invites CBEX Scam Victims to Assist Investigation.

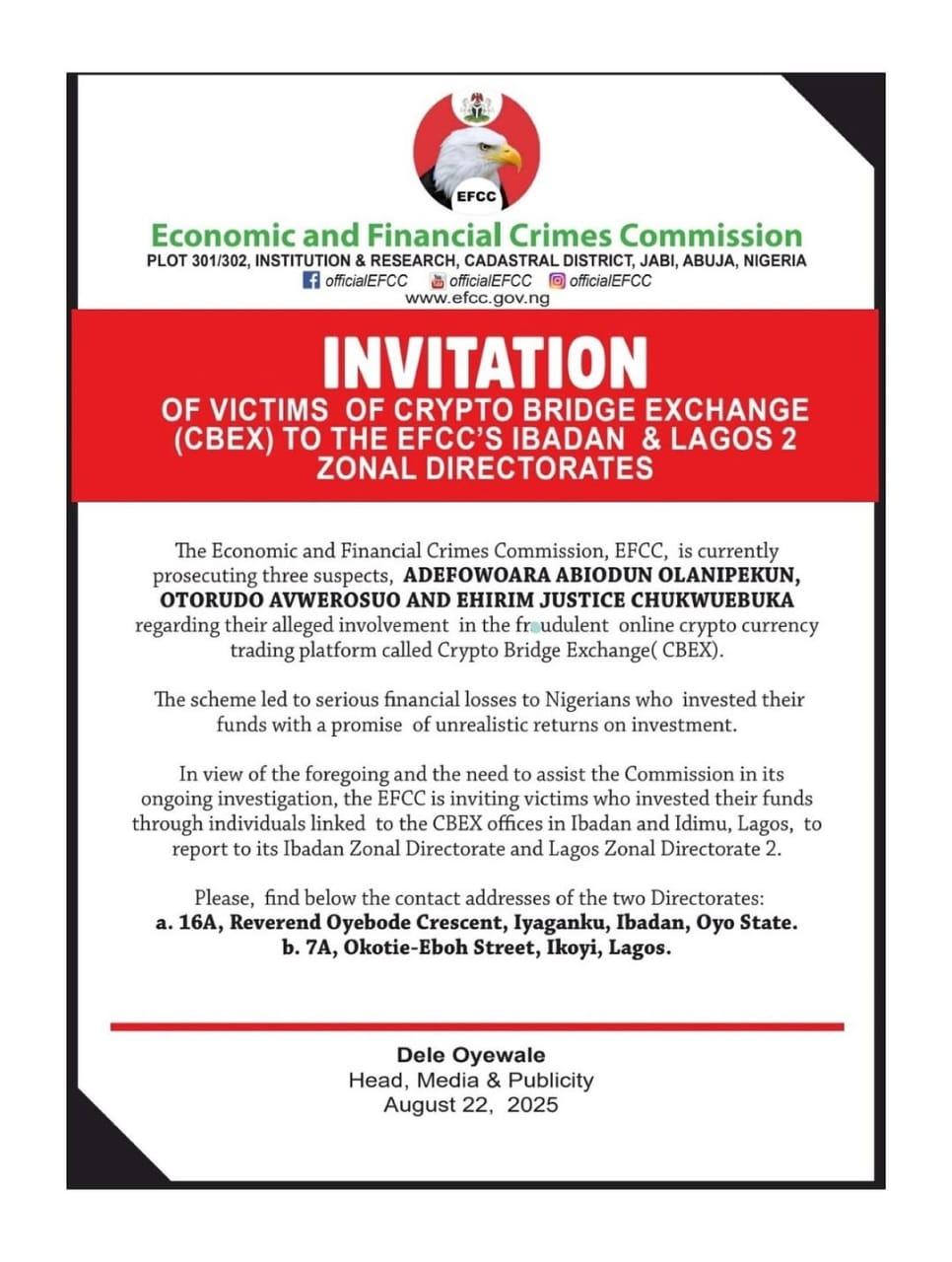

The Economic and Financial Crimes Commission (EFCC) has urged Nigerians defrauded by the cryptocurrency platform, Crypto Bridge Exchange (CBEX), to visit its Ibadan and Lagos zonal offices to support ongoing investigations.

In a statement released on Friday by its Head of Media and Publicity, Dele Oyewale, the commission confirmed it is prosecuting three suspects — Adefowora Olanipekun, Otorudo Avwerosuo, and Ehirim Chukwuebuka linked to the scheme.

According to the EFCC, CBEX enticed investors with promises of unrealistic returns, leading to huge financial losses for many. The agency appealed to affected victims, particularly those who transacted through CBEX-linked offices in Ibadan and Idimu, Lagos, to come forward and assist in the probe.

The Economic and Financial Crimes Commission (EFCC) has urged Nigerians defrauded by the cryptocurrency platform, Crypto Bridge Exchange (CBEX), to visit its Ibadan and Lagos zonal offices to support ongoing investigations.

In a statement released on Friday by its Head of Media and Publicity, Dele Oyewale, the commission confirmed it is prosecuting three suspects — Adefowora Olanipekun, Otorudo Avwerosuo, and Ehirim Chukwuebuka linked to the scheme.

According to the EFCC, CBEX enticed investors with promises of unrealistic returns, leading to huge financial losses for many. The agency appealed to affected victims, particularly those who transacted through CBEX-linked offices in Ibadan and Idimu, Lagos, to come forward and assist in the probe.

EFCC Invites CBEX Scam Victims to Assist Investigation.

The Economic and Financial Crimes Commission (EFCC) has urged Nigerians defrauded by the cryptocurrency platform, Crypto Bridge Exchange (CBEX), to visit its Ibadan and Lagos zonal offices to support ongoing investigations.

In a statement released on Friday by its Head of Media and Publicity, Dele Oyewale, the commission confirmed it is prosecuting three suspects — Adefowora Olanipekun, Otorudo Avwerosuo, and Ehirim Chukwuebuka linked to the scheme.

According to the EFCC, CBEX enticed investors with promises of unrealistic returns, leading to huge financial losses for many. The agency appealed to affected victims, particularly those who transacted through CBEX-linked offices in Ibadan and Idimu, Lagos, to come forward and assist in the probe.

0 Σχόλια

·0 Μοιράστηκε

·1χλμ. Views