JRB Abolishes All Road Stickers, Calls for End to Illegal Roadblocks and Non-State Revenue Collection

In a communiqué issued at the conclusion of its 158th meeting held December 9-10 at Transcorp Hilton, Abuja, the Joint Revenue Board (JRB) outlined strong measures against unauthorized revenue practices and support for national tax reforms.

The communiqué reads:

“The Board commends the Federal Government for the far-reaching fiscal policy and tax reforms, noting their potential for enhanced revenue mobilization, promotion of economic competitiveness, improvement of ease of doing business, and deepened fiscal sustainability across the federation.

”The Board lauded the transition of the Joint Tax Board into the Joint Revenue Board, noting that it represents a bold step towards a more coordinated, efficient and coherent national revenue administration framework.

“The Joint Revenue Board is expected to strengthen collaboration among revenue authorities, enhance information sharing, and improve tax compliance nationwide.

”The Board affirmed that the future of tax administration hinges on accurate, comprehensive and interoperable data, and resolved that strengthening data sharing frameworks and deploying analytics tools for revenue administration purposes will promote streamlined processes and harmonization of revenue practices.

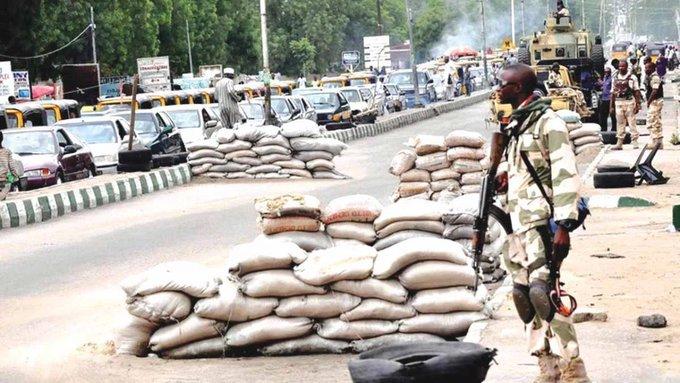

“The Board restates its commitment to eradicating the menace of non-state actors in the nation's revenue administration value-chain, and calls on the Office of the National Security Adviser, Nigeria Police Force, and all relevant security agencies to take immediate steps towards eliminating illegal road-blocks mounted and operated along the nation's road transport corridors for the purpose of collection of taxes, levies, rates and charges, while ensuring the integrity of the nation's tax administration process, especially at the sub-national level.

“The Board re-emphasizes the outright abolition of the design, production, issuance and enforcement of all manner of road stickers and related instruments by both state and non-state actors, and encourages the resistance of such by Nigerians, and the reporting of all such promoters of the issuance of stickers and related instruments to security authorities for appropriate sanctions.

“The Board calls on all States to expedite action in the passage of the Harmonized Taxes and Levies (Approved List for Collection) Bill into Law, for uniform application of taxes, rates, and levies at the sub-national level, in line with the national objectives of the ongoing tax reforms.”

JRB Abolishes All Road Stickers, Calls for End to Illegal Roadblocks and Non-State Revenue Collection

In a communiqué issued at the conclusion of its 158th meeting held December 9-10 at Transcorp Hilton, Abuja, the Joint Revenue Board (JRB) outlined strong measures against unauthorized revenue practices and support for national tax reforms.

The communiqué reads:

“The Board commends the Federal Government for the far-reaching fiscal policy and tax reforms, noting their potential for enhanced revenue mobilization, promotion of economic competitiveness, improvement of ease of doing business, and deepened fiscal sustainability across the federation.

”The Board lauded the transition of the Joint Tax Board into the Joint Revenue Board, noting that it represents a bold step towards a more coordinated, efficient and coherent national revenue administration framework.

“The Joint Revenue Board is expected to strengthen collaboration among revenue authorities, enhance information sharing, and improve tax compliance nationwide.

”The Board affirmed that the future of tax administration hinges on accurate, comprehensive and interoperable data, and resolved that strengthening data sharing frameworks and deploying analytics tools for revenue administration purposes will promote streamlined processes and harmonization of revenue practices.

“The Board restates its commitment to eradicating the menace of non-state actors in the nation's revenue administration value-chain, and calls on the Office of the National Security Adviser, Nigeria Police Force, and all relevant security agencies to take immediate steps towards eliminating illegal road-blocks mounted and operated along the nation's road transport corridors for the purpose of collection of taxes, levies, rates and charges, while ensuring the integrity of the nation's tax administration process, especially at the sub-national level.

“The Board re-emphasizes the outright abolition of the design, production, issuance and enforcement of all manner of road stickers and related instruments by both state and non-state actors, and encourages the resistance of such by Nigerians, and the reporting of all such promoters of the issuance of stickers and related instruments to security authorities for appropriate sanctions.

“The Board calls on all States to expedite action in the passage of the Harmonized Taxes and Levies (Approved List for Collection) Bill into Law, for uniform application of taxes, rates, and levies at the sub-national level, in line with the national objectives of the ongoing tax reforms.”

0 Comments

·0 Shares

·104 Views