-

Donald Trump Amplifies Bizarre Theory Claiming Joe Biden Was Replaced by a Clone

On Saturday night, former U.S. President Donald Trump shared a strange and controversial post on his social media platform, Truth Social. The post claimed that President Joe Biden actually died in 2020 and has since been replaced by a clone or other artificial stand-in.

The original message, written by a user named “llijh,” stated:

“There is no Joe Biden — executed in 2020. Biden clones, doubles, and robotic engineered soulless mindless entities are what you see. Democrats don’t know the difference.”

Trump did not comment directly on the claim but re-shared it without any explanation, leading to widespread confusion and intense debate online.

Social media quickly lit up, with reactions ranging from disbelief to conspiracy-fueled excitement.

“We all knew something was off,” one user commented, referencing Trump’s past remarks suggesting harm had come to Biden.

Another added, “I can’t believe President Trump just reTRUTHED this,” referring to Trump’s action of resharing posts on Truth Social.

As the post gained traction, Trump’s replies section was filled with speculation, conspiracy theories, and cheering supporters.

“Well, you just went there! Go you! The truth is coming! Buckle up!” one excited follower wrote.

Despite the attention, the theory remains completely baseless and unfounded — part of a growing trend of viral misinformation circulating on fringe platforms.Donald Trump Amplifies Bizarre Theory Claiming Joe Biden Was Replaced by a Clone On Saturday night, former U.S. President Donald Trump shared a strange and controversial post on his social media platform, Truth Social. The post claimed that President Joe Biden actually died in 2020 and has since been replaced by a clone or other artificial stand-in. The original message, written by a user named “llijh,” stated: “There is no Joe Biden — executed in 2020. Biden clones, doubles, and robotic engineered soulless mindless entities are what you see. Democrats don’t know the difference.” Trump did not comment directly on the claim but re-shared it without any explanation, leading to widespread confusion and intense debate online. Social media quickly lit up, with reactions ranging from disbelief to conspiracy-fueled excitement. “We all knew something was off,” one user commented, referencing Trump’s past remarks suggesting harm had come to Biden. Another added, “I can’t believe President Trump just reTRUTHED this,” referring to Trump’s action of resharing posts on Truth Social. As the post gained traction, Trump’s replies section was filled with speculation, conspiracy theories, and cheering supporters. “Well, you just went there! Go you! The truth is coming! Buckle up!” one excited follower wrote. Despite the attention, the theory remains completely baseless and unfounded — part of a growing trend of viral misinformation circulating on fringe platforms.· 0 Comments ·0 Shares ·20 Views ·0 Reviews1

-

0 Comments ·0 Shares ·39 Views ·0 Reviews

-

-

How Tenants Suffer in Silence

Tenants are often the most vulnerable in the housing system, and their suffering is deep but rarely acknowledged.

Many are forced to live in poor conditions — leaking roofs, unreliable electricity, broken plumbing, or homes infested with pests. Yet, when they report these issues, landlords may delay or ignore repairs completely.

Financially, tenants carry a heavy burden. Rent can consume 40% to 70% of their income, leaving little for food, transport, or emergencies. Some are forced to borrow money just to keep a roof over their heads. To make matters worse, they often face unfair and illegal charges — non-refundable inspection fees, inflated caution deposits, hidden agent fees, or unexplained renewal costs.

Evictions are another silent crisis. Tenants can be thrown out with little or no notice, even when they’ve tried to pay or negotiate in good faith. They often suffer in silence because they fear backlash or don’t fully know their rights. This lack of voice makes them easy targets for exploitation.

Discrimination also plays a role — some landlords refuse to rent to people based on tribe, religion, marital status, or even the number of children they have. Add to that the stress and time wasted walking long distances for inspections, paying multiple agents, and dealing with broken promises — and it becomes clear: being a tenant, especially in low- to middle-income areas, is a constant struggle.

The suffering of tenants is real. It is financial, emotional, and psychological — and it’s time their voices were heard.How Tenants Suffer in Silence Tenants are often the most vulnerable in the housing system, and their suffering is deep but rarely acknowledged. Many are forced to live in poor conditions — leaking roofs, unreliable electricity, broken plumbing, or homes infested with pests. Yet, when they report these issues, landlords may delay or ignore repairs completely. Financially, tenants carry a heavy burden. Rent can consume 40% to 70% of their income, leaving little for food, transport, or emergencies. Some are forced to borrow money just to keep a roof over their heads. To make matters worse, they often face unfair and illegal charges — non-refundable inspection fees, inflated caution deposits, hidden agent fees, or unexplained renewal costs. Evictions are another silent crisis. Tenants can be thrown out with little or no notice, even when they’ve tried to pay or negotiate in good faith. They often suffer in silence because they fear backlash or don’t fully know their rights. This lack of voice makes them easy targets for exploitation. Discrimination also plays a role — some landlords refuse to rent to people based on tribe, religion, marital status, or even the number of children they have. Add to that the stress and time wasted walking long distances for inspections, paying multiple agents, and dealing with broken promises — and it becomes clear: being a tenant, especially in low- to middle-income areas, is a constant struggle. The suffering of tenants is real. It is financial, emotional, and psychological — and it’s time their voices were heard.· 0 Comments ·0 Shares ·52 Views ·0 Reviews1

-

Happy Birthday, Ibrahim Muhammad!

Wishing you a day filled with joy, peace, and purpose as you celebrate another year of life. May this new chapter bring you greater wisdom, endless opportunities, and the strength to chase your dreams without fear.

You’re a blessing to those around you—may you continue to grow in grace, inspire others, and shine in everything you do. Here’s to health, success, and many more years of happiness.

Have a fantastic celebration!

— Abuh Sadiq Usman

🎉 Happy Birthday, Ibrahim Muhammad! 🎉 Wishing you a day filled with joy, peace, and purpose as you celebrate another year of life. May this new chapter bring you greater wisdom, endless opportunities, and the strength to chase your dreams without fear. You’re a blessing to those around you—may you continue to grow in grace, inspire others, and shine in everything you do. Here’s to health, success, and many more years of happiness. 🎂🎈🎁 Have a fantastic celebration! — Abuh Sadiq Usman· 0 Comments ·0 Shares ·88 Views ·0 Reviews1

-

China Warns U.S. Not to ‘Play with Fire’ Over Taiwan After Pentagon Chief’s Remarks

China has issued a stern warning to the United States, urging it not to “play with fire” over Taiwan, following remarks by U.S. Secretary of Defense Pete Hegseth at a security summit in Singapore.

Speaking at the Shangri-La Dialogue on Saturday, Hegseth accused China of actively preparing for a military takeover of Taiwan. He said Beijing was “credibly preparing” for an invasion and had been “rehearsing for the real deal” as part of broader efforts to shift the balance of power in Asia.

In response, China’s Foreign Ministry issued a statement just after midnight on Sunday, saying it had made “solemn representations” to Washington over what it called “inflammatory remarks.”

“The U.S. should not try to use the Taiwan issue as a bargaining chip to contain China and should not play with fire,” the ministry warned.

According to AFP, China — which did not send its Defense Minister Dong Jun to the summit — reaffirmed its position that Taiwan is a domestic matter and foreign countries have no right to interfere.

Beijing considers Taiwan a breakaway province and has not ruled out the use of force to assert control over the self-governed island.

During his address, Hegseth also accused China of “illegally seizing and militarising lands” in the contested South China Sea. Although a 2016 international tribunal ruled that China’s sweeping claims in the region have no legal basis, Beijing maintains control over key areas and continues its military buildup.

China’s Foreign Ministry responded by denying any obstruction to freedom of navigation, insisting that “there has never been any issue” in the region. A spokesperson stated that China is committed to defending its “territorial sovereignty and maritime rights in accordance with the law.”

The ministry also criticized U.S. military activity in the region, accusing Washington of turning the Indo-Pacific into a “powder keg” by deploying advanced weapons systems to the South China Sea.China Warns U.S. Not to ‘Play with Fire’ Over Taiwan After Pentagon Chief’s Remarks China has issued a stern warning to the United States, urging it not to “play with fire” over Taiwan, following remarks by U.S. Secretary of Defense Pete Hegseth at a security summit in Singapore. Speaking at the Shangri-La Dialogue on Saturday, Hegseth accused China of actively preparing for a military takeover of Taiwan. He said Beijing was “credibly preparing” for an invasion and had been “rehearsing for the real deal” as part of broader efforts to shift the balance of power in Asia. In response, China’s Foreign Ministry issued a statement just after midnight on Sunday, saying it had made “solemn representations” to Washington over what it called “inflammatory remarks.” “The U.S. should not try to use the Taiwan issue as a bargaining chip to contain China and should not play with fire,” the ministry warned. According to AFP, China — which did not send its Defense Minister Dong Jun to the summit — reaffirmed its position that Taiwan is a domestic matter and foreign countries have no right to interfere. Beijing considers Taiwan a breakaway province and has not ruled out the use of force to assert control over the self-governed island. During his address, Hegseth also accused China of “illegally seizing and militarising lands” in the contested South China Sea. Although a 2016 international tribunal ruled that China’s sweeping claims in the region have no legal basis, Beijing maintains control over key areas and continues its military buildup. China’s Foreign Ministry responded by denying any obstruction to freedom of navigation, insisting that “there has never been any issue” in the region. A spokesperson stated that China is committed to defending its “territorial sovereignty and maritime rights in accordance with the law.” The ministry also criticized U.S. military activity in the region, accusing Washington of turning the Indo-Pacific into a “powder keg” by deploying advanced weapons systems to the South China Sea.· 0 Comments ·0 Shares ·103 Views ·0 Reviews1

-

Internet Fraudster Jailed in Uyo

Justice Maurine Adaobi of the Federal High Court sitting in Uyo has convicted and sentenced Elijah Okwa Etenrulimre to three months imprisonment for offences bordering on criminal impersonation on the cyberspace.

Etenrulimere was arraigned by the Economic and Financial Crimes Commission ,EFCC, Uyo Zonal Directorate, on Thursday May 29, 2025, on a one count criminal charge for his illicit activities on the internet.

The charge against Etenrulimre reads;

“That you, Elijah Okwa Etenrulimre (aka Kaley Couco), sometime in 2024, in Nigeria, within the jurisdiction of this Honourable Court, did fraudulently present yourself as Kaley Couco on social media with the intent to gain advantage for yourself, and thereby committed an offence contrary to Section 22(2)(b)(i) of the Cybercrimes (Prohibition, Prevention, etc.) (Amendment) Act, 2024 and punishable under the same Section.”

When the charge was read to him, he pleaded ‘guilty.

In view of his plea, prosecution counsel, Enobong Ubokudom prayed the court to convict the defendant and sentence him in accordance with the provisions of the law.

But the defence counsel, Samson Awuje, pleaded for leniency and urged the court to temper justice with mercy and give the defendant a second chance on the grounds that he was remorseful and had promised not to return to crime.

After listening to both counsel, Justice Adaobi convicted and sentenced Etenrulimre to three months jail term to run from the date of his arrest and custody, or pay a fine of Two Hundred Thousand Naira (₦200,000).

The convict was arrested at his residence in Okuku, Yala Local Government Area of Cross River State, on May 5, 2025, by a team of operatives during a sting operation. He was found to be involved in internet fraud, He was thereafter arraigned and convicted.Internet Fraudster Jailed in Uyo Justice Maurine Adaobi of the Federal High Court sitting in Uyo has convicted and sentenced Elijah Okwa Etenrulimre to three months imprisonment for offences bordering on criminal impersonation on the cyberspace. Etenrulimere was arraigned by the Economic and Financial Crimes Commission ,EFCC, Uyo Zonal Directorate, on Thursday May 29, 2025, on a one count criminal charge for his illicit activities on the internet. The charge against Etenrulimre reads; “That you, Elijah Okwa Etenrulimre (aka Kaley Couco), sometime in 2024, in Nigeria, within the jurisdiction of this Honourable Court, did fraudulently present yourself as Kaley Couco on social media with the intent to gain advantage for yourself, and thereby committed an offence contrary to Section 22(2)(b)(i) of the Cybercrimes (Prohibition, Prevention, etc.) (Amendment) Act, 2024 and punishable under the same Section.” When the charge was read to him, he pleaded ‘guilty. In view of his plea, prosecution counsel, Enobong Ubokudom prayed the court to convict the defendant and sentence him in accordance with the provisions of the law. But the defence counsel, Samson Awuje, pleaded for leniency and urged the court to temper justice with mercy and give the defendant a second chance on the grounds that he was remorseful and had promised not to return to crime. After listening to both counsel, Justice Adaobi convicted and sentenced Etenrulimre to three months jail term to run from the date of his arrest and custody, or pay a fine of Two Hundred Thousand Naira (₦200,000). The convict was arrested at his residence in Okuku, Yala Local Government Area of Cross River State, on May 5, 2025, by a team of operatives during a sting operation. He was found to be involved in internet fraud, He was thereafter arraigned and convicted.· 0 Comments ·0 Shares ·124 Views ·0 Reviews1

-

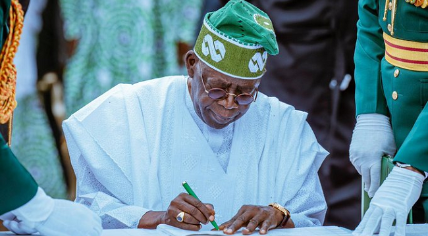

Tinubu Signs Executive Order On Fresh Incentives For Oil Sector

The move is to further strengthen Nigeria’s global competitiveness and attract greater investment into the sector.Tinubu Signs Executive Order On Fresh Incentives For Oil Sector The move is to further strengthen Nigeria’s global competitiveness and attract greater investment into the sector.1 Comments ·0 Shares ·80 Views ·0 Reviews -

PSG Thrash Inter Milan To Win First-Ever Champions League Title

Qatari-owned PSG are just the second French club since Marseille in 1993 to win European football's top trophy.PSG Thrash Inter Milan To Win First-Ever Champions League Title Qatari-owned PSG are just the second French club since Marseille in 1993 to win European football's top trophy.0 Comments ·0 Shares ·81 Views ·0 Reviews -

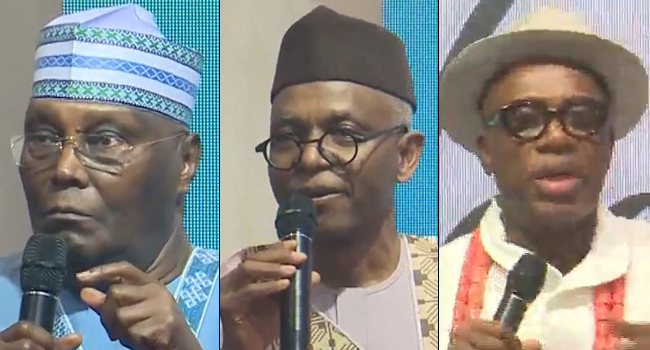

VIDEO: ‘Tinubu Govt Weaponising Poverty’, Say Atiku, El-Rufai, Amaechi

They spoke at a public lecture held in honour of Amaechi who clocked 60 in Abuja, the nation's capital on Saturday.VIDEO: ‘Tinubu Govt Weaponising Poverty’, Say Atiku, El-Rufai, Amaechi They spoke at a public lecture held in honour of Amaechi who clocked 60 in Abuja, the nation's capital on Saturday.· 1 Comments ·0 Shares ·85 Views ·0 Reviews1

-

Ground rent defaulters in the FCT are trooping to the office of the Abuja Geographic Information Systems to pay rent debts before the expiration of the two-week ultimatum given by President Bola Tinubu, Saturday PUNCH has gathered.Ground rent defaulters in the FCT are trooping to the office of the Abuja Geographic Information Systems to pay rent debts before the expiration of the two-week ultimatum given by President Bola Tinubu, Saturday PUNCH has gathered.0 Comments ·0 Shares ·132 Views ·0 Reviews

More Stories